Blog

Weekly Scorecard (New and Revised) 12-21-09

I am starting a new format for the Weekly Scorecard. I am including both West Bellevue and South Bellevie. This is just the start in transitioning this website to one that addresses all of Bellevue. Instead of a narrative I am putting the information in spreadsheet format. This way we can see trends like in the Distrssed Inventory Report.

A couple of comments. Overall the activity remains surprisely high but as I have mentioned in other post pricing seems stuck. East Bellevue has good numbers this week but the per sq. ft. price was right at the usual $225. In the other markets we will see how trends develop. In West Bellevue there were only three closed sales and one of them was essentially a land sale of a very small tear down home so the numbers were skewed. What really was of interest was in South Bellevue where a home on the Golf Course in The Reserve at Newcastle finally closed. This home was owned by the FDIC as a result of its take over at Westsound Bank. This home had a number og offers on it, mainly netween a $1,000,000 and $1,100,000 before it want back. It took the FDIC forever to determine the value and get the home back on the market. It was listed at $1,265,000 and was on the market for 15 days. It looked like a bidding war started and the home actually closed at $1,371,000. As I see the new construction inventory depleting I see more and more of these homes going over the asking price for the bank owned homes. The MLS number on this home is 290148809 if you want to check it out. Many purchasers are tiring of the short sales and when a bank owned home can be obtained where a timely closing can occur then it seems to attract a lot of interest from those buyers. There is also one bank owned home in West Bellevue on Evergreen Point road that went pending this week I suspect the same thing happened; there was a bidding war and it went over the listing pricing. New homes in good condition seem to be in demand. Also in addition to the spreadsheet I have attached a graph showing the dwindling new construction inventory.

Spreadsheet Link with Weekly Scorecard: Weekly scorecard 12-21-09

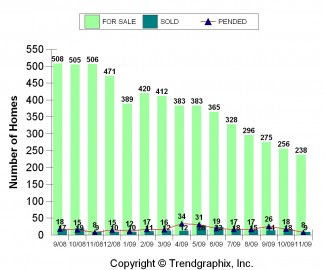

This Graph Below is for all New Construction on the Eastside from $800,000 to $3,000,000

Tags:

Discussion: No Comments

Distressed Inventory Report 12-19-09

Well it has happened. In every market the distressed inventory declined a little but the NTS/Foreclosure ratio went up. What this means is that more homes are being given their “Notice of Trustee” (NTS) sale than homes that were bank owned. In order to establish a trend both numbers need to move in the same direction. Having this oscillation along with conflicting ratios and inventories with the NTS/Foreclosure ratio up and the overall inventory down means we are just oscillating in a trading range.

In talking with the one of the owners of the local Trustee Services; these are the guys who post the sale and take the property through foreclosure as the “Trustee” for the owner; said that there will be a rising swell of foreclosures the first of the year. This will be caused by the banks figuring out how to deal with two big changes in the law. The first is that in Washington State 30 days has been added to the foreclosure process since lenders are now required to try to make contact with the borrowers in order to see if there is an alternative to foreclosure. The shortest time period that can occur for foreclosure from when the payments were last being made is 220 days. The other law that changes things is a federal law that states if there is a tenant in the home now the tenant will have 90 days to vacate. This one is very interesting and is causing some strange dynamics. Some of the owners aware of these laws are now renting out bedrooms in their homes or vacating the property and renting it. They don’t make the payment and they keep the rent. Technically once the foreclosure occurs and the bank takes title to the property, the bank is entitled to the rent but good luck getting the money. Theoretically an owner could stop making payments and get almost a year’s rent while the property goes through foreclosure and the bank takes possession. If you have a very shrewd owner they could try to renegotiate the loan or short sale the property and pull out at the last minute and drag the process out to 18 to 24 months and keep collecting rent. If more owners wise up to this it could throw a big wrench in the works before the lender can get possession of the property and be able to sell it.

The one that is pretty certain is that most of the new construction available has been foreclosed on and that inventory will decline. I am now seeing banked owned newer homes in good locations like West Bellevue, Mercer Island, Kirkland and The Reserve at Newcastle that are well priced now have multiple offers and these are homes well over a $1,000,000. One just went on Evergreen Point Road in 5 days that was listed for a $1,399,000. I suspect it went over full price. Also in November a lot of the Lux and Bayridge inventory in Kirkland that had been foreclosed on and sitting got cleaned out. In the Reserve at Newcastle there are no new listed homes at this time. This time last year there were over thirty listed homes now it is about five. Looks like more homes coming but from what I am seeing they will be older resales so you had better get to know the folks at Home Depot.

The link for the spreadsheet is here:Bellevue Foreclosure Report 12-19-09

Tags: bank owned, Distressed Inventory, foreclosure, notice of trustee sale, report, Weekly

Discussion: No Comments

Lenders: Naming Names

Lender’s are everyone’s favorite punching bag but here I am going to relate some of my experiences good and bad. First of all let me start with my endorsements. Kudos to Brian Yotz the local branch manager at Golf Savings Bank. Brian took over and closed a transaction in less than eight days after another lender took six weeks and couldn’t undwrite themselves out of a wet paper bag. Brian was local and oversaw each step of the transaction to obtain this timely closing. The other lender derserving special mention is Wendy Mariani at Loan Central. Again she oversaw the process personally and did not hand it off to a call center. The underwrting was done locally and the loan was processed in less than two weeks.

Now for the Duds. The worst lender award to goes to Suntrust. This was a “call center” lender. Originally the borrowers thought they would get better service by going to the lender who held their present mortgage. Well as soon as they called their lender the call went into a call center and it took three days to get back to them I should have known we were in trouble then. The loan was being originated out of a call center in Virginia and it was apparent that there was a big disconnect in this process. The original processor handling the loan was trying to help. It took a couple of calls to relate the urgency of getting this closed and explain this was a short sale and the home was being purchased “as is”. The borrower was golden and she thought that she could help us to get this done. Well that is where things feel apart. There were two big problems. The first was they seemed to have a very convoluted process for determining the borrower’s downpayment and to verify that it was not borrowed. I won’t go into all the machinations to get this done but the originator in Virginia was very helpful and very frustrated. The second and bigger problem was that when the appraisal came in the underwriter in Virginia really hammered the property and wanted all sorts of work done before closing. Specifically the home was 5 years old and needed maintenance. It looked fine but needed a coat of paint inside and out and some lawn maintenance. Well when the underwritier in Virginia saw the appraisal he freaked and requested the exterior be painted, the inside painted, new carpet and requested a new driveway because of some cracking. Now keep in mind this home was perfectly liveable had no defered maintenance like a leaky roof, mold, etc. but was just not in great shape. By this standard 90% of the homes on the market would not be financeable by this lender. Bottom line we tried to work with the lender but we would do something and then a whole new set of conditions would come up. At one point in time I had a discussion with the call center manager if the lawn needed to be replaced or just mowed. Were the weeds “systemic” or could they just be pulled. Well after this conversation the borrower above went to Brian and got the home closed they requested a couple of things which were done promptly and the home closed.

The other lender which we have had general problems with is Bank of America. On one loan which was an old home in Seattle in order for Bof A to fund they requested the garage be torn down. This was an old detached garage that had sills rotted on it. It was not part of the house and more importantly it was a vested structure. The bottom line is that it had no connection to house and if torn down could not be built again so in the long run it would actually contribute to value. Generall the buyers rehab these things by jacking them up and replacing the sills so the structure remains vested. Well again this was an underwriter that was not local and she insisted the rot be fixed in the garage. Usually this is only done if it is attached to the house and can affect the house. No pictures or amount of “clarification” could make this situation go away and the closing date was near and a ton of people were interested in this home. Well the solution was simple we tore down the garage. That made the rot go away and the lender was happy. This is the first time I have had to devalue a property to get a loan. The other more general issue with BofA is their pricing is good on their jumbos and they say they will do a jumbo with a credcit score of 680 as opposed to the 720 required by other lenders but good luck getting it. Again the problem here is the huge disconnect between the underwriter and the person originating the loan.

The point to make about these experiences is that having the originator and the underwriter local is a big deal. The irnoy is that the mortgage companies seem to be doing a better job. They have their local underwriters and they communicate clearly with the originators. Also the local folks overseeing the loan are very competent setting expectations and overseeing the gathering of the documentation and appraisal. Also they order appraisals locally from well qualified appraisers that know the market and the “call center” appraisers used by many lenders is avoided. The irony here is that these mortgages companies often will sell the loan to a SunTrust or BofA but in that situation you have the local underwritier talking to the other underwriter. They seem to get things done much better. So work with local people. Avoid the call centers and stay out of that mess. If you are with a large bank such as BofA or Chase you can go into the local branch and think you are getting that service but the application is taken and turned over to the call center and it is then out of control of the local originators hands. These folks are well meaning but are fighting a system that is not responsive or flexible. When Glass-Stegall was repealed in 1999 the “call center” approach to banking took hold with a vengenace. This was the new model of efficiency. Central processing and underwriting. If your lender gives you an 800 number to check on your loan application of if they have to call one to get the status of it run.

As a consumer movement we should ask to get rid of the “call center” banking model. Tell Chase, Wells, US Bank and any other bank if you go into to see the manager and they give you an 800 number to go jump. Make them call their own 800 number and go through 800 number HELL. The branch managers used to be the ones who kept customers happy and did the follow up. Banks that have strong branch systems, like Chase, Wells of BofA are under utilizing the local branches. Think how quickly short sales could get done if handled at the branch level. When I say get done, I don’t necessarily mean approved. I mean that the short sale could be resolved quickly on what terms the bank would approve it. The process now of having to sustain a certain amount of abuse and wasted time is not efficient. Efficiency is not somebody reciting from a policy manual which is what happens at the call centers. This is turning into a rant so I had better end it now.

Tags: call centers, lenders, originators, underwriters

Discussion: 2 Comments

Weekly Scorecard 12-14-09

This week the inventories were at 239 homes just up two from last week. Inventories do not appear to be climbing. There were four sales this week with prices ranging from $350,000 to $550,000; pretty typical for East Bellevue. The average per sq. ft. sales price was $222 per sq. ft. Again pretty typical. There was one bank owned home and one short sale. This is the most we have seen in a long time in any batch of sales.

There were three pending sales this week. One of the them was a $5,800,000 waterfront on Lake Sammamish. The other two were homes under $400,000 so running averages this week would be meaningless but it will be interesting to see what the closed number of the $5,800,000 waterfront is if it closes.

Next week there will be a different format. I will be adding West Bellevue and South Bellevue and start presenting the numbers in a spreadsheet format as the site transitions to one which includes all of Bellevue.

Tags: average price per sq. ft., pending, Scorecard, sold, Weekly

Discussion: No Comments

Distressed Inventory Report 12-12-09

There is a definite trend developing. It is not dramatic but gradually creeping. The number of distressed properties overall continues to rise and the NTS/Foreclosure ratio is inching back up after declining for three months. The only MLS area whose NTS/Foreclosure ratio that is still under 1.00 is West Bellevue but it is also gradually creeping up. There is not enough momentum in the swings to tell if this is seasonal because sales are slowing down. It also appears that some of the sellers are getting more aggressive on pricing. Some of the per sq. ft. numbers for the asking price for relatively generic homes appear to be above the traditional averages for the last three months. As has been discussed before this market is extremely price sensitive and has shown no sort of support for any sort of price increases. The seller needs to keep in mind demand is very weak in this market and to some extent discretionary depending on the value presented.

Click the link for the spreadsheet. Bellevue Foreclosure Report 12-12-09

Tags: Distressed Inventory, foreclosure, NTS, NTS/Forelosure ratio

Discussion: 1 Comment

Weekly Scorecard 12-7-09

Well better late than never. Here are the numbers for last week’s East Bellevue Real Estate Market. Inventory dropped again to 237 homes. This low inventory is again testing the bottom and is one of the lowest levels since the report began. As has been discussed earlier I am not sure if this is seasonal with sellers removing homes from the market or if it is a case where we are running out of sellers being forced to bring their property to the market.

There were 7 homes sold this week.; however all the action was mostly under $500,000. Of the 7 homes sold only one was over $500,000. The average home sale price was $430,571. The average per sq. ft. sales price was right at the typical EB average of $224 per sq. ft. There appeared to be no bank owned homes in this last round of sales and one short sale. Also again this week there was one home on the market that sold over the list price in two days. This confirms the trend of a large number of buyers who are trolling the internet for new well priced listings, when they see it they react quickly. If you are a seller try finding the market from the bottom up, i.e. price low to create urgency and drive the price up to the market price. Pricing at or even slightly above the market only sets you up for low offers and puts you in a position of having to continually drop price to find the market. This strategy only results in an extended sales period and in my opinion ultimately a lower price since you are captive to that one buyer when they make the offer.

Last week there were no pending sales however this week 7 homes went pending. The average list price of the pending homes was $650,379. The average per sq. ft. pending sales price was $217. In this batch of homes were two bank owned homes. Again pricing is static. No upward pressure on pricing but if you are seller the market is well defined at where you have to price to sell.

Tags:

Discussion: No Comments